Our Endowment

St John’s endowment income was for long derived almost

entirely from its North Oxford estate. That estate was built on land owned by

the College almost since its foundation and as a suburb of the city in the

nineteenth century as the suburb of North Oxford. In the 1960s the Governing

Body adopted a radical change of strategy. This was partly a matter of choice,

and partly the result of legislation, in particular the Leasehold

Enfranchisement Act of 1967 which gave many holders of long leases the right to

buy the freehold of their properties. The new objective was to realise funds

from North Oxford to reinvest in college buildings and increase the number of

tutorial fellows.

St John’s endowment income was for long derived almost

entirely from its North Oxford estate. That estate was built on land owned by

the College almost since its foundation and as a suburb of the city in the

nineteenth century as the suburb of North Oxford. In the 1960s the Governing

Body adopted a radical change of strategy. This was partly a matter of choice,

and partly the result of legislation, in particular the Leasehold

Enfranchisement Act of 1967 which gave many holders of long leases the right to

buy the freehold of their properties. The new objective was to realise funds

from North Oxford to reinvest in college buildings and increase the number of

tutorial fellows.

Plans were made for what is now the Thomas White Building. The fellowship went outside its own number for the first time to elect the distinguished mediaeval historian Richard Southern as President and promising young tutors such as John Carey and Keith Thomas were appointed; I came to St John’s as part of this recruitment drive.

But in the 1970s things started to go wrong. As construction of the Thomas White Building was in progress, inflation accelerated, reaching an annual rate of 27% in 1974. Management of the funds realised from the Oxford estate had been outsourced to Kleinwort Benson, the investment bank; but between 1972 and 1974 the stock market fell by two thirds and the value of government stocks plummeted to levels never seen before or since. Exchange control at that time prevented institutions from investing directly in foreign securities but Kleinworts had circumvented these restrictions by taking out a loan in Swiss francs to buy American shares. When Nixon abandoned the gold standard in 1971 the Swiss franc soared relative to the dollar and the cost of the loan became crippling.

At the beginning of 1975, the College sacked Kleinworts and repaid the loan. After a beauty parade, the firm of Fielding Newson Smith was appointed as our principal brokers and Christopher Clayton, a young partner in the firm, became an adviser, a position he occupied with skill and humour for more than thirty years. (At Big Bang, he joined Cazenove, which still advises the College.) The Thomas White building was completed, to a scaled-back plan, in 1975 and two years later the academic staff fully ‘took back control’ when Bill Hayes became Bursar; I supported him on the investment side (with a lot of help from George Fleet) and importantly we recruited John Montgomery - astonishingly, his was the first appointment of a full time qualified chartered accountant in the University. When Bill was elected President in 1986 he was succeeded as Bursar by Tony Boyce and twenty years later by Andrew Parker; the College has been fortunate to find three fellows with both an academic background and the practical skills to oversee its financial management.

I assumed the role of Investment Officer and we were at first adventurous, even reckless; we bought physical silver and sold it at ever increasing prices to Bunker Hunt, the Texas (soon to be ex-) billionaire who tried to corner the world market. After exchange control ended in 1979 we appointed a (still little known in London) firm called Goldman Sachs to manage an American portfolio and subsequently added a Japanese portfolio. But Goldman Sachs outgrew us, and at the end of the 1980s we resumed oversight of the American holdings and with fortunate timing quit Japan. (We have not been back.)

For the last two decades of the twentieth century, it was hard to go wrong in investment markets. Inflation and interest rates fell and stock markets boomed. The College’s finances were again secure. Work could begin on the Garden Quad, which was completed in 1995.

As the century ended on a final burst of irrational exuberance in the New Economy bubble, we could stand back and reassess our position. The benefits of a long-term perspective became evident as one saw the events of Wall Street’s roaring twenties reproduce themselves, not just in outline but in considerable detail. After the meeting at which we agreed with Christopher Clayton that we would sell our entire holding in Vodafone (the company by then accounted for an absurd 15% of the entire value of the stock market) and reduce similar holdings of technology stocks, I asked how many similar discussions he had heard; the answer was none. A lesson of history is that when no-one remains to be infected, epidemics end.

But another lesson of history is that while people tend to overestimate the short-term pace of technological innovations such as the internet they also tend to underestimate their impact in the long run. After the bubble burst, we employed an American boutique asset manager, Edgewood, to manage a growth-oriented American portfolio; a decision which has worked out well in the long run and especially so in the current pandemic.

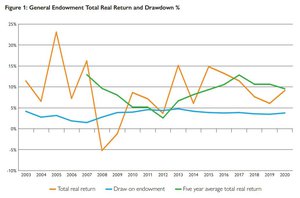

But by 2006, as work began on the last major expansion of

the College’s residential accommodation, the new madness was in credit markets.

There seemed almost no asset classes in the world which were not overvalued,

but one was German property. And so we acquired some Berlin apartment blocks.

When the global financial crisis broke in 2008, there were some losses on

equities and property but our exposure to financial stocks was limited and our

extensive diversification served us well; a boring Australian index-linked bond

increased in value by 70%. Overall the endowment was robust and the Kendrew

Quad was completed in 2010.

But by 2006, as work began on the last major expansion of

the College’s residential accommodation, the new madness was in credit markets.

There seemed almost no asset classes in the world which were not overvalued,

but one was German property. And so we acquired some Berlin apartment blocks.

When the global financial crisis broke in 2008, there were some losses on

equities and property but our exposure to financial stocks was limited and our

extensive diversification served us well; a boring Australian index-linked bond

increased in value by 70%. Overall the endowment was robust and the Kendrew

Quad was completed in 2010.

But in normal circumstances bonds are not an appropriate asset category for an institution like St John’s – the experience of the 1970s had demonstrated the devastating consequences of a surge in inflation. We more or less eliminated our exposure to bonds and indeed reversed it after 2010 by taking long-term loans. A bizarre consequence of quantitative easing was that the few institutions which were credible issuers of debt with a thirty- or forty-year time horizon could borrow long term at rates below three per cent. We could and did.

We continued to diversify, buying property in San Francisco

and Seattle and increasing our exposure to Asia, now the principal driver of

global growth. As markets recovered from the global financial crisis we could

safely undertake the latest expansion of college buildings – the new library

and study centre. Today more than half of the College endowment is invested

overseas, and although half of the assets are in property the historic

commitment to Oxford real estate is long gone – although the current Oxford

North development, close to Pear Tree and the new Parkway station, will for a

time increase again our engagement in Oxford.

We continued to diversify, buying property in San Francisco

and Seattle and increasing our exposure to Asia, now the principal driver of

global growth. As markets recovered from the global financial crisis we could

safely undertake the latest expansion of college buildings – the new library

and study centre. Today more than half of the College endowment is invested

overseas, and although half of the assets are in property the historic

commitment to Oxford real estate is long gone – although the current Oxford

North development, close to Pear Tree and the new Parkway station, will for a

time increase again our engagement in Oxford.

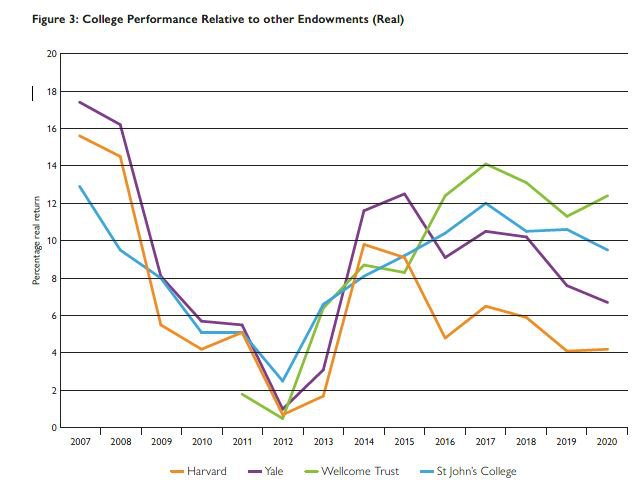

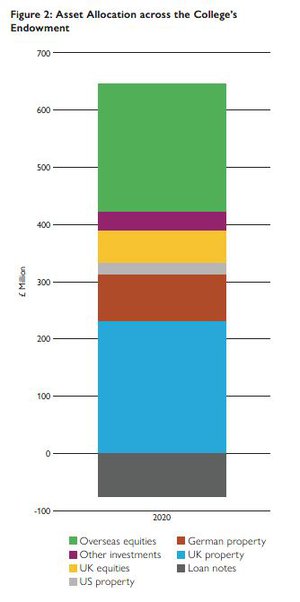

How well have we performed? Our strategy is to seek total return, treating income and capital gains as equivalent; our sole benchmark a target yield of 5% per annum real above inflation over rolling five-year periods. It is a target we have consistently achieved, enabling us to contribute an annual sum – now almost £20 million per year – to the College’s academic purposes while growing the endowment for future generations.

But the real measure of our success over the last fifty years has been the fulfilment, beyond any reasonable expectation, of the vision of our predecessors in the 1960s. We have mobilised resources to provide the best and most extensive accommodation and facilities of any Oxford college. We provide generous financial support to our students, to research, and to the University and other colleges. We have raised the once middling academic standards of the College to a level which attracts the best faculty and students and consistently tops the Norrington table. And we have given the College as secure a financial future as is available in an uncertain world. It is an achievement in which everyone who has been part of the College community in that era can take pride.